Happy Thursday, Blockfolians

The Lede

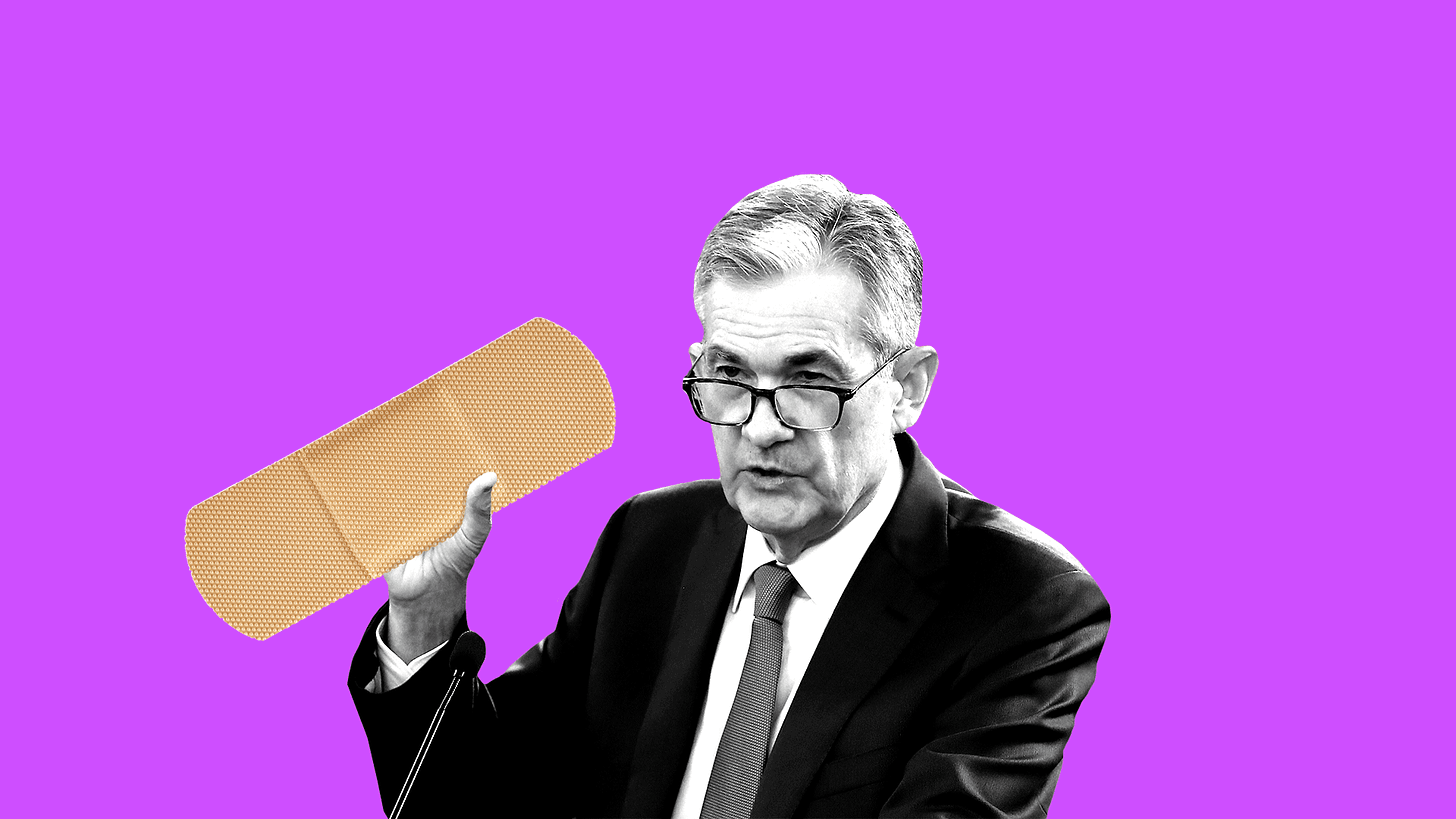

In a much anticipated speech for the annual (though this year virtual) Jackson Hole conference held by the Kansas City Fed, Fed Chair Jerome Powell articulated a new policy framework centered around a new approach to inflation:

Forty years ago, the biggest problem our economy faced was high and rising inflation. Today, the persistent undershoot of inflation from our 2 percent longer-run objective is a cause for concern.

The change, in short, is that rather than targeting a 2% inflation rate specifically, the Fed is now looking for an average inflation rate of 2%. That means that if there has been an extended period below that number (such as we’ve experienced over the last ten years), the Fed would be looking to actively go over 2% inflation to counter balance.

The takes came hot and fast:

ShapeShift’s Erik Vorhees summed up the feelings of a lot of bitcoiners:

It’s hard not to feel like the tectonic plates that underpin our financial system are changing. The question is simply: what happens next?

Enjoying Blockfolio’s Market Refresh? Sign up to have it delivered every day.

Highly Relevant Reading

Uh oh! Code bugs kick 13% of Ethereum nodes offline

Russia appears to be blocking bitcoin-related websites

More DeFi startup funding news as dashboard startup Zapper nabs $1.5M

Wow! More than 95% of crypto futures volume comes from Asia

Community Commentary

Interesting take on evolving attitude of the Chinese crypto community to DeFi

Speaking of DeFi, a slightly cynical but still interesting take from BitMEX’s Arthur Hayes

A Really Big Number We Should Be Paying Attention To

$100 Million

That’s the size of DCG’s new bet on bitcoin mining

Final Thought

In memes we trust.