Bitcoin Miners Made More In April Than March. Here's Why That Matters.

Plus a big spike in bitcoin ATM usage.

Happy Friday, Blockfolians

The Lede

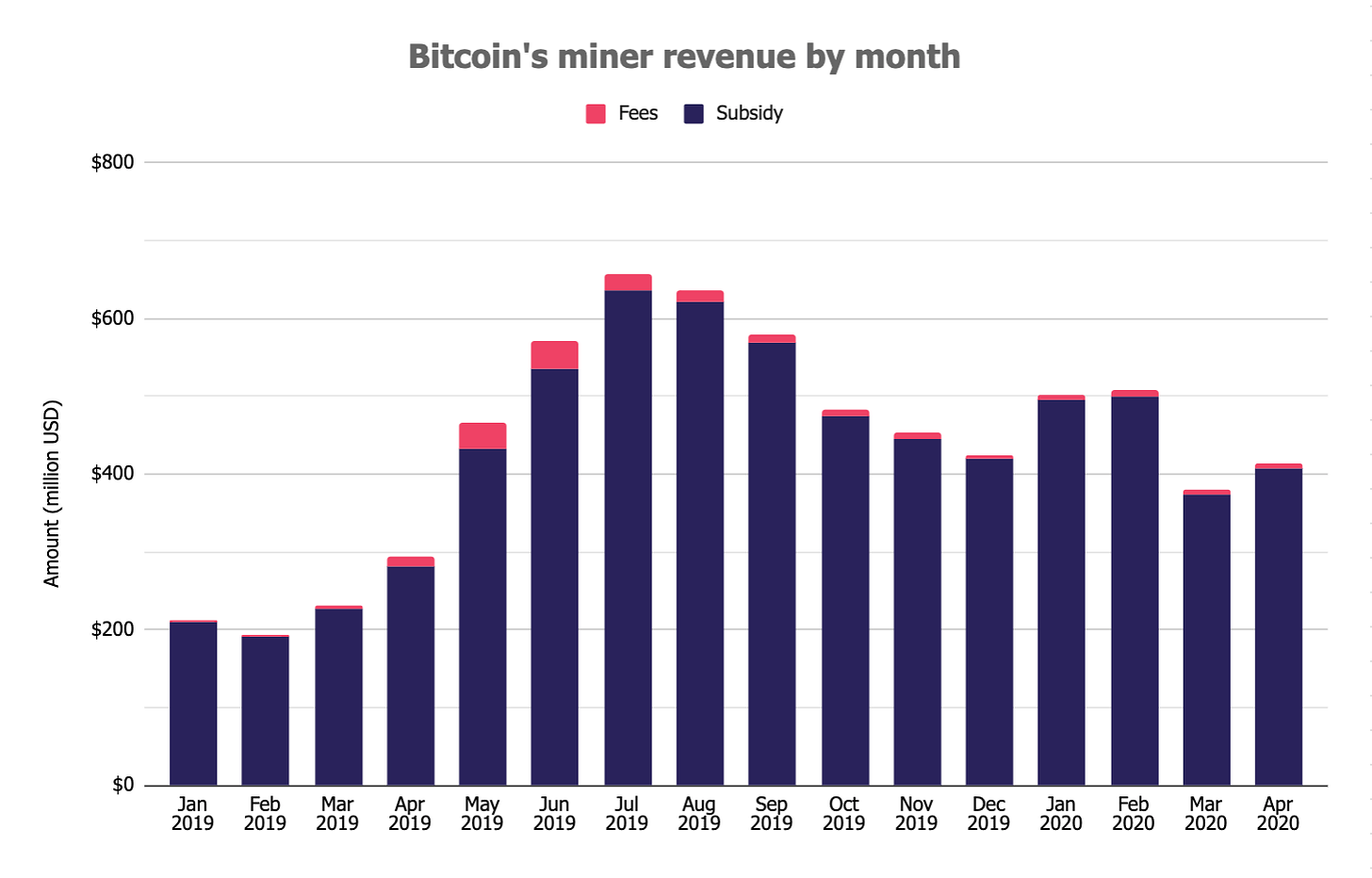

Bitcoin miners made $412.5m in April, up 8% over the 380% they made in March. Rising prices explain the difference, but the significance in the context of the upcoming halving is worth exploring.

Reducing the block reward by half fundamentally changes the economics for many miners and organizations. Halving events can have the effect of driving less efficient miners out of business (or at least force them to focus elsewhere).

The price rally has made mining more valuable and more viable. From a CoinDesk piece last week:

According to the miner profitability index, tracked by mining pools PoolIn and F2Pool, older mining rigs, such as Bitmain's AntMiner S9 or Canaan's Avalon A851, can now generate a 10% to 20% gross margin at an average electricity cost of $0.05 per kilowatt-hour (kWh).

Why it matters? More mining competition means a more secure, distributed network.

Enjoying Blockfolio’s Market Refresh? Sign up to have it delivered every day.

Highly Relevant Reading

Well hello there 40% spike in Bitcoin ATM usage

Swiss crypto broker is Bitcoin Suisse is raising at a $280m pre-money valuation

Yield launches to bring fixed rate lending and borrowing to Ethereum

Ripple and Stellar co-founder Jed McCaleb has sold more than $175m of XRP since 2016. Wow!

Community Commentary

CoinDesk’s Leigh Cuen has just finished a great 3-part series on bitcoin in emerging markets including Africa, Latin America, and the Middle East

In the mood for a bitcoin epic? Read about the 4th bitcoin epoch.

A Really Big Number We Should Be Paying Attention To

$66,000,000

That’s the size of a new fund of funds from one of the earliest bitcoin mining operations

Final

Well, are you prepared?